Why you should check if you have a right to a fixed interest rate housing loan during negative equity.

Negative equity often occurs to an interest-only mortgage holder. When homeowners are in negative equity, it means that their properties are less worth than the mortgages secured on them. Interest-only mortgage holders are usually exposed to a high risk of negative equity than those on a repayment mortgage (Karmaziene and Varanauskiene 2014).

Such a scenario arises since the monthly payments only go towards settling the interest as opposed to reducing the debt value. Approximately 500,000 properties in the UK are currently in negative equity (van Veldhuizen et al. 2020). However, some regions are more affected than others.

For instance, it is estimated that two out five properties in Northern Ireland purchased after 2005 are currently in negative equity. This article looks at some of the rights that individuals with negative equity may have to alleviate negative equity problems. Finally, the implications of negative equity in the UK and the EU have been discussed.

Rights of Housing Loan Borrowers During Negative Equity

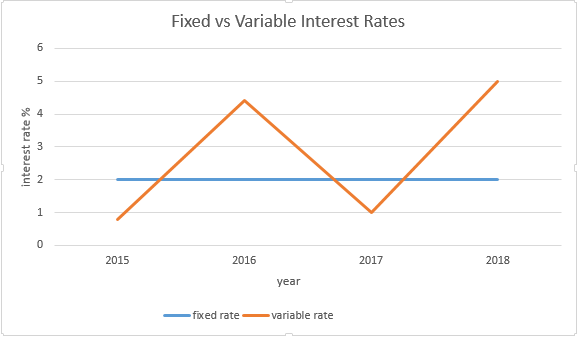

A house loan borrower on a variable interest rate loan can access fixed interest rates when in negative equity guided by some rights (Gerardi et al. 2013). Firstly, one can wait until the house price increases. Negative equity does not usually last for a long time unless during extreme scenarios such as the global financial crisis.

Therefore, waiting for one year or more would help a negative equity homeowner to get through the problem. During the waiting period, a negative-equity homeowner is encouraged to continue making payments to be debt-free.

Secondly, an overpayment on the current mortgage is encouraged. Paying off one’s existing mortgage would be a great plan for homeowners to adopt during negative equity. Since not many negative equity homeowners can afford to make upfront mortgage payments, a monthly rate could be the best option (Bernstein 2017).

Such an option ensures that one clears the debt quickly and ultimately come out of the negative condition. However, the majority of fixed-rate mortgages offer early repayment charges, but whether such charges are worth paying during a negative equity situation to switch to a lower variable interest rate loan to repay more debt is one reason you need advice.

Thirdly, homeowners in negative equity may request their banks for a switch from a variable interest rate home loan to a fixed interest rate home loan. Fixed interest rate home mortgages are loans with fixed rates for a given period, as illustrated in the chart below.

The period for such loans varies across countries in the EU. Most homeowners in several EU countries currently favors fixed-rate mortgages (Linn and Lyons 2020). For example, a 2017 survey conducted by the UK financial conduct authority in 2017 found that 90% of homeowners preferred fixed-rate mortgages (Stanga et al. 2020).

Fixed-rate mortgages could help to reduce the negative impacts associated with negative equity. This is because a fixed-rate mortgage loan helps to lock negative equity homeowners into an agreement made at the time of entering a mortgage contract. However, a lender is unlikely to approve a new mortgage for individuals in negative equity since their properties would not provide sufficient collateral.

Instead, most lenders are unlikely to allow individuals with negative equity to switch to a new mortgage deal upon the expiry of the existing one (Oliner et al. 2020). Even if individuals in negative equity wanted to remortgage, such a scenario would likely make individuals in negative equity to be stuck on the lenders’ standard variable rate upon the expiry of the initial mortgage deal.

However, switching a home mortgage from a variable-rate to a fixed-rate is allowable under difficult economic situations as outlined under the interest rates and other costs schedule in the European standardized information sheet (Bruloot et al. 2019). The following is an example of a request a negative equity homeowner can make to their bank requesting a change from variable interest rate loan to fixed interest rate loan:

“I wish to bring to your attention that I am currently on a variable interest rate home loan, but my the market value of my home is less worth than the mortgage secured on it due to the decline in prices in housing markets. In this regard, I am seeking your approval to switch to a fixed interest rate housing loan without penalty due to the housing market downturn in the country.”

Clearly, it is to your advantage to send this letter is you consider that it is possible that you may enter into negative equity in the foreseeable future:

“I wish to bring to your attention that I am currently on a variable interest rate home loan, but the market value of my home could become worth less than the mortgage secured on it due to the decline in prices in housing markets. In this regard, I am seeking your approval to switch to a fixed interest rate housing loan without penalty due to the housing market downturn in the country.”

In both cases mentioned above you should seek early advice before taking action. Ring The Money Advice Service (0800 138 7777)

Finally, homeowners with negative equity are entitled to rent their current properties. Renting out the property can help one work through negative equity as many lenders agree to this arrangement under extreme circumstances (Oliner et al. 2020). Such an option will help negative equity homeowners to accrue money that can help them to either move or pay their way out of negative equity while they rent themselves.

Implications for Negative Equity in the UK, EU, and Other Regions

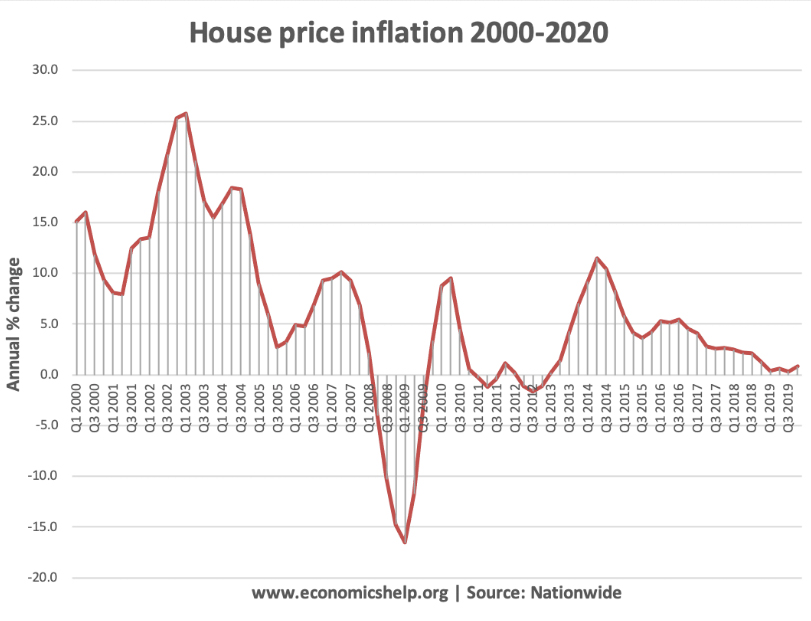

Different countries across Europe, including the UK, Spain, Greece, and Ireland, have been severely affected by the burden of negative equity in recent years. There are different reasons why negative equity is a dominant problem in the EU. Financial crises are the main causes of negative equity in the UK and the rest of the countries in the EU (Phaup 2015).

For instance, a large proportion of the current mortgage lockdowns in the UK and EU could be attributed to the ripple’s effects associated with the 2008 global financial crisis (Fuster and Willen 2017). The financial crisis caused house prices to fall, making banks to go into disarray.

The effect of this crisis on the housing market was severe, with approximately 1.2 million homeowners plunging into negative equity as reported by the Bank of England (Aron and Muellbauer 2016). The chart below illustrates how house prices have been declining over the years in the UK.

Brexit has also contributed to negative equity in the EU. For instance, house prices are expected to reduce by an average of 6% in the event of no-deal Brexit (Stanga et al. 2020). Such a scenario could contribute to problems of negative equity.

Other countries such as Spain and Portugal also got severely affected by the 2008 financial crisis, and the impact on housing markets are still felt to date. These situations are particularly worrying for homeowners as most of the EU countries have adopted a recourse legislature that transfers the entire burden of mortgage debt on to consumers’ shoulders.

Conclusion

Negative equity makes both the lenders and borrowers both vulnerable. This is because borrowers with negative equity cannot completely repay their loan by selling the property. The most appropriate strategy out of the problem of negative equity is by negotiating for favorable loan repayment methods with the lender.

This may possibly be by requesting a change from variable interest rate mortgage to the fixed-rate mortgage rate when rates are at a historic low. However, what is clear is that you need advice early to ascertain the best course of action. It is important that you re-read the final paragraph on this website’s homepage

The Importance of Getting Advice Early

This website is about why you need to get advice early. It provides general information only and is not a recommendation to act in any way other than to seek advice early. In the United Kingdom the starting place always should always be to Ring The Money Advice Service (0800 138 7777).

Their advice is free and impartial. However, if you feel that you want to independent paid for advice from a financial planner The Money Advice Service has guidance on how to select a financial planner which you can read by clicking here and if you believe you want specific mortgage advice and are considering getting a mortgage adviser you should read this article here.

References

1. Aron, J. and Muellbauer, J., 2016. Modelling and forecasting mortgage delinquency and foreclosure in the UK. Journal of Urban Economics, 94, pp.32-53.

2. Bernstein, A., 2017. Negative equity, household debt overhang, and labor supply. Working paper.

3. Bruloot, D., Callens, E. and De Muynck, M., 2019. Credit intermediation and the European internal market for mortgage credit. Law and Financial Markets Review, 13(1), pp.41-53.

4. Fuster, A. and Willen, P.S., 2017. Payment size, negative equity, and mortgage default. American Economic Journal: Economic Policy, 9(4), pp.167-91.

5. Gerardi, K., Herkenhoff, K., Ohanian, L.E. and Willen, P., 2013. Unemployment, negative equity, and strategic default. Available at SSRN 2293152.

6. Karmaziene, E. and Varanauskiene, J., 2014. Selection of Short-Term Fixed Interest Rate Mortgages in an Emerging Market: The Case of Lithuania. Bank of Lithuania Working Paper 16/2014, Bank of Lithuania, Vilnius, Lithuania.

7. Linn, A., and Lyons, R.C., 2020. Three triggers? Negative equity, income shocks and institutions as determinants of mortgage default. The Journal of Real Estate Finance and Economics, 61(4), pp.549-575.

8. Oliner, S.D., Peter, T.J., and Pinto, E.J., 2020. The wealth building home loan. Regional Science and Urban Economics, 80, p.103389.

9. Phaup, H., 2015. Historical sources of mortgage interest rate statistics. Bank of England.

10. Stanga, I., Vlahu, R. and de Haan, J., 2020. Mortgage arrears, regulation, and institutions: Cross-country evidence. Journal of Banking & Finance, 118, p.105889.

11. van Veldhuizen, S., Vogt, B. and Voogt, B., 2020. Negative home equity reduces household mobility: Evidence from administrative data. Journal of Housing Economics, 47, p.101592.

If you wish to comment on an article or post, please use the contact form below.